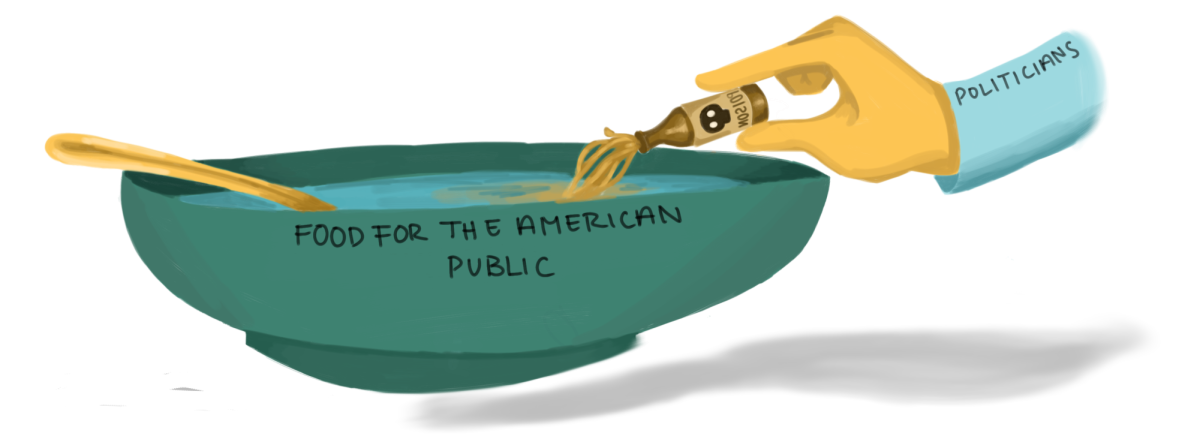

Everyone you know likely pays their fair share of taxes, but what about the nation’s biggest corporations? All corporations are taxed at a rate of 21%, yet due to tax loopholes, refunds and lobbying politicians to lower tax rates, over 80 companies paid less than 10% in taxes this year. The nation’s millionaires and billionaires evade more than $150 billion a year in taxes. But as they thwart billions from the federal government, the everyday people suffer.

While tax evasion increases corporate profit and individual wealth, it harms the federal government and the economy by creating a budget deficit, decreasing revenue and increasing wealth inequality. That $150 billion could have gone to improving or strengthening resources everyday Americans rely on, such as education, healthcare and social security. More budget cuts are on their way too, through Project 2025.

Project 2025 is the Heritage Foundation’s guide for the next Republican president. It plans to introduce tax cuts for the wealthy, federal budget cuts and the abolishment of government-funded divisions like the national bank, education, healthcare, security, climate change and debt relief.

Federal budget cuts last year made it harder for families to afford child care, students to receive federal student aid and the IRS to enforce and regulate tax laws. Project 2025 would be fatal to lower class Americans as it would eliminate the welfare programs they rely on.

Wealth inequality is an issue affecting nearly everyone. Every year, a small group of billionaires and big corporations take larger and larger shares of wealth, leaving the majority, low and middle-class with less and less. This consolidation of power at the top endangers economic democracy in the United States. Big corporations can and do spend millions to retain their hold of the political sphere in their hands, blocking regulatory legislature and pushing for profitable benefits that often hurt the common people. It’s like they have a special vote button only they can use, except it’s a million times more effective.

But there is power in the majority. Support those who say no to all forms of tax evasion– whether it be federal budget cuts on welfare programs or tax cuts for corporations and the wealthy.