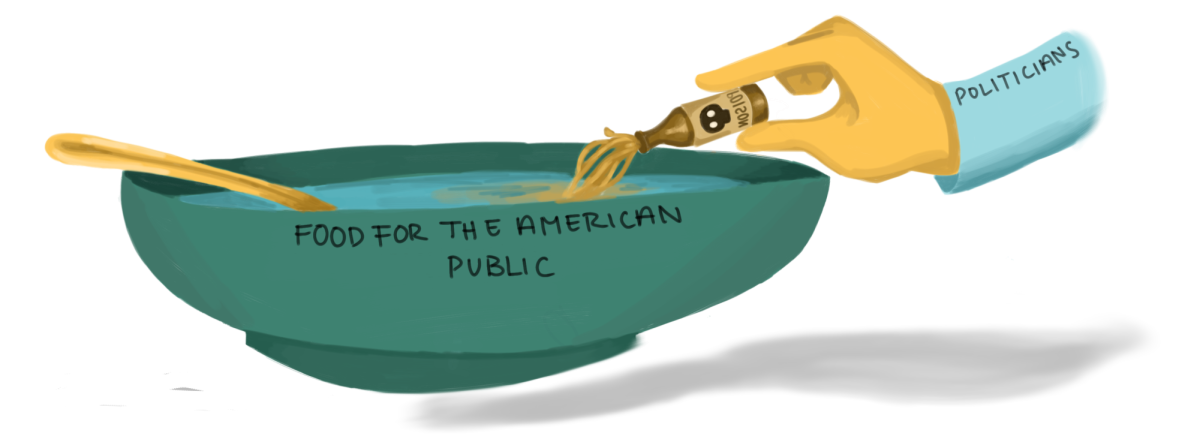

Corporations and governments are separate entities. Corporations pursue monetary profit, whereas the government represents the people. As 13 billionaires and the world’s richest man have been inaugurated into office by our billionaire president, it’s less likely that regulations on the system that made these elite politicians rich will actually be enforced. But if corporate activity is not regulated, the protection of consumers’ personal data, market security and safety becomes endangered.

For instance, despite laws requiring companies to protect users’ personal data, corporations can still sell that data or leave it vulnerable to leaks. In 2016, when the personal data of 57 million users and drivers of Uber was breached, the company bribed the hackers responsible to be quiet. Yet despite intentionally keeping the breach under wraps for a year, the company did not have to face any immediate financial consequences. It was only until a year later that the FTC (Federal Trade Commission) made them pay a $148 million settlement with state attorney generals.

Around that time, news broke out about a similar event known as the Cambridge Analytica scandal, where it was revealed that Facebook allowed third-party apps to harvest personal data from millions of non-consenting users. Again, it wasn’t until the following year when the FTC had them pay $5 billion, but only for broader privacy concerns — not the initial data sharing issue. Instances like these exemplify the issue of companies neglecting the security of consumer data and only taking financial responsibility for any resulting damage when federal regulatory committees force them to pay up. Companies who have been involved in these leaks have in some instances changed their security regulations after the incident, been subject to long investigation periods or could have not been aware of the data breach at all. But the point is that there wouldn’t be justice for the consumers impacted by data breaches and mismanagement if not for federal regulators.

These regulators have further investigated corporate monopolies, surveillance pricing and price dynamism, all of which could disrupt fair market security for consumers. One of the most recent cases was the merging of one of the largest supermarket companies, which was blocked by the FTC. If it was successful, it would allegedly eliminate business and employee competition, lead to higher grocery prices for consumers and lower product quality and wages for workers. Last year, regulators launched an investigation of eight companies suspected of surveillance pricing, a business practice using consumer data like purchasing behavior, location and browsing history to set personalized pricing for their goods and services.

Companies who were not on that list include Uber, who utilize dynamic pricing algorithms to set their prices higher for consumers and drivers under circumstantial conditions, even when potentially unsafe or unpredictable. The algorithm also affects their drivers, who face low and inconsistent pay meant to maximize profit for the company. This goes to show the impact the FTC has had on regulating corporate action on behalf of consumers, not profit and how much more there is to be done to ensure a fair market for all.

Even more, federal regulation on corporations can protect consumer rights to safety. To illustrate, Boeing had for several years allegedly neglected quality and safety concerns during manufacturing, avoiding pilot retraining and upgrading training manuals to maximize short-term earnings. This prompted whistleblowers like the former employee John Barnett to file lawsuits, in which he could not continue due to his alleged suicide. His suits weren’t unfounded either — in 2018 and 2019, two 737 Max 8 plane crashes killed 346 people, prompting a federal investigation into the company. In the end, Boeing pleaded guilty to felony fraud charges. They had misled regulators and the public about the aircraft’s safety, taking lives in the process.

This lax regulation of businesses and its consequences on societal welfare isn’t new. For example, the Industrial Revolution’s Gilded Age marked the growth of the economy, technological innovation and urbanization, but also the inequalities of wealthy businessmen profiting at the expense of the people. Under a non-regulated market, factory workers, including women and children, faced overcrowding, pollution, public health crises and often worked long hours with little pay in unsafe conditions. It wasn’t until the government interfered with the economy that worker’s lives improved. After all, corporations started facing regulatory policies, labour movements began to be taken seriously and social safety nets were provided for the first time.

Nevertheless, improvements have not been universal. Lax regulation in India left its poorest vulnerable to child labour, modern day slavery and unsafe working conditions, despite strict labour laws. Even in developed nations like South Korea, elite companies have great influence on the government, successfully lobbying to keep the nation’s long working hours, low labor costs and corporate tax benefits — perpetuating mental health concerns for the nation’s workers. It’s clear that working class people worldwide still suffer when corporate greed and negligence is able to run awry, too.

When a few elite companies are trusted responsible for the functionality and maintenance of society, the people’s interests are neglected — because their systems are designed for profit, not the well-being of their consumers. So in order to secure data, safety and fairness of the market for all, corporations must be regulated through the following actions: First, Citizens United needs to be overturned to limit the amount of influence they have on the federal government. Second, voters must be cognizant of who they elect, knowing that who they choose would determine welfare budgets, regulation policies and the extent of corporate political power. Third, a comprehensive national privacy law must be established to strengthen their accountability in safeguarding user data. Every American should have the right to opt out of their data being sold. After all, the government’s duty is to represent the people — not businesses.

Grace Kweon • Feb 27, 2025 at 7:51 am

Hi, author here! I’ve been sick recently over many weeks, so I haven’t been able to get the sources + extended version in. I’m trying to get it updated as soon as possible.

Grace Kweon • Mar 1, 2025 at 1:32 pm

updated!