Four years of classes. That’s it. These four years of classes determine how someone is thought of, how much demand there is for their services and how much money a person can make. College did not used to be the key determinant of one’s future. According to Brittanica, only 5 percent of people, aged 18 to 21 were enrolled in college in 1900. Tuition at an elite school, Brown University, totaled $105. Comparatively, tuition at Brown University today is over $65,000. Although tuition continues to in- crease at this dramatic rate, an increasing amount of students continue to fork over the hefty amount of money required for going to college nowadays.

Class

The rising costs of college have presented a challenge particularly for people of a lower financial status, and heavily reduced opportunities for social mobility. These rising costs can be credited to the government reducing their willingness to allocate money to colleges, putting the financial burden of operational funds on students. According to Nasdaq Personal Finance, between 1980 and 2020, the average price of college with all expenses included has risen by 169%, compared to a 19% wage increase for workers aged 22-27. Having gone through nine years of schooling for his doctorate in education, Ladue math teacher Ryan Rzeszutko empathizes with the decision students are faced with.

“How many 18-year-olds actually know where they want their life to take them?” Rzeszutko said. “You’re being asked to make a decision and bank on a degree that you may not end up doing anything with. It’s really hard to be asked at that age to put that much money on the table when so much is uncertain.”

To avoid the mistake Rzeszutko alludes to, students without the means to attend college debt free are forced to evaluate whether college is the right decision. While the majority of his family have come to terms with the debt attached to college, Cooper Helm (11) has other ideas.

“My plan for after high school is to get into a trade, maybe become an electrician,” Helm said. “Based on what I see myself doing, there’s just no point spending that much money. I don’t want to live a life controlled by my debt.”

Student loans don’t just affect lives after college, they place barriers on what college students of lower financial status have access to. According to Statista.com, out of the top 25 highest rated academic institutions, all but three of them have a tuition above $57,000 per year, three times the cost of the average tuition in the U.S. Having worked with Ladue students navigating the college system for six years, College and Career Advisor Chad Sisk understands the barriers that exist for top schools.

“Families who haven’t saved as much money for college don’t necessarily have the opportunity to look at out-of-state schools or private schools,” said Sisk. “I think [financial status] does limit the opportunities that exist for lower income families.”

To combat the barriers that financial status has on access to higher education, colleges work with the government to offer financial aid. While it can make a substantial dent in tuition, college is still expensive regardless of the amount of aid one receives, especially with room and board, academic supplies, food and various other expenses that aren’t made cheaper by aid.

“If you look at the rising costs of tuition across the country, the financial aid amounts are not rising equally,” said Sisk. “I don’t think the federal government has done a good job increasing the [monetary] amounts that students are eligible for in order to keep up with the rising cost of tuition.”

According to The Education Data Initiative, college will cost an individual student an average of $36,436 per year in the US with everything factored in. The decision on whether it’s worth it to commit that type of money to a college degree really is dependent on the person.

“Actually think about the decision yourself,” said Helm. “Make sure to factor in all the expenses and everything else that goes into it. I made sure I didn’t let people think for me or make a decision for me.”

The high cost of college is seen to be worth it by many due to the increase in earnings down the line. According to the Association of Public and Land-Grant Universities, typical earnings for a bachelor’s degree holder are $36,000, or 84 percent higher, than those without. In its original form college was about learning, while now, students are forced to make a decision revolving around the financial risk and reward of college.

“I believe education should be for all,” said Rzeszutko. “If somebody wants to better themselves by pursuing a further education, they should have the ability to do so without worrying about the bills that follow them for the rest of their life.”

Under Pressure

“Three dollars and fifteen cents please.” Sliding four dollars across the counter, the student collects the change and an energy drink. On the drive back home, they turn on those mind-numbing review videos, attempting to concentrate. Sitting at their desk, a familiar struggle emerges – nodding off, eyelids becoming heavier with every passing sentence read. Did the Celsius not work? They know they can’t afford to fall asleep; bombing the test isn’t an option. They can’t take that risk, it would mean nearly sacrificing their future, right? What college would accept them? So back at it, head drooping, they turn to the next page of notes.

The intensity surrounding college admissions, fueled by societal expectations, lead to an environment where students feel compelled to sacrifice their mental health and prioritize reputations of colleges over personal fit. Amidst the high stakes and escalating costs of education, there is a growing question resonating in the U.S.: Is the pursuit of college really worth the stress and financial burden?

At Ladue in 2021, the rate of students going to college was 86% according to the Ladue district website. To some, Ladue has formed a toxic environment around college.

“At Ladue, surrounding the idea of college, I feel like it’s a giant contest,” senior Kate Goodman said. “I see people [saying] ‘This person got in there; I don’t know how they did that. Their GPA was low. My ACT score was higher.’ People are always saying stuff like that.”

Goodman committed to Boston College and will pursue a major in environmental geoscience next fall. Throughout the application process, she heard gossip about where people were applying and whether or not others thought it was the right choice. These comparisons took a toll on her.

“I never really had a doubt in my mind that I was going to college,” Goodman said. “But, at some point, I was stressed out because I felt I was always trying to compare myself to other people.”

Guidance counselors witness the toll on students as they navigate the competitive culture.

“If we can keep in mind that it’s about finding the right fit instead of the biggest name or the highest ranked, we can find the best fit for each individual,” guidance counselor Leah Jones said. “A lot of students carry that [pressure] on their own because they think that everyone else has it together.”

In the fight to build up the strongest transcript, AP classes are infamous for their stress-inducing curriculum. What’s more enticing to an admissions officer than excelling in the most challenging classes? So, some students find themselves picking out classes based on rigor rather than interest.

“Success will come once you actually find that true enjoyment,” College and Career advisor Diana Redden said. “It’s going to be exhausting trying to do everything and be perfect because that’s unrealistic for anyone.”

Financial Limitations

For senior Asher Speicher, he wanted a different path. Speicher is going to attend United States Air Force Academy, a four year military university in Colorado.

“I didn’t really want to attend a typical university because I was searching for something more meaningful than just college,” Speicher said. “I thought military service was something that suited me better.”

The Air Force Academy is a tuition-free school where graduates leave with a Bachelor’s degree in science and commission into the Air Force as a second lieutenant, serving for a minimum of five years.

“Cost [of college] has definitely impacted my decision,” Speicher said. “For a number of years, I was living in a single parent household, and we did not have much money. I knew wherever I went to college, I would have to pay for it myself.”

Thousands of students around the country find the cost of education to be burdening. According to Think Impact 2021, 51.04 percent of college students drop out because they cannot afford college, 55 percent struggle to fund their education and 79 percent postpone their graduation due to high tuition rates.

“I feel like people don’t realize that we live in such a privileged and affluent area that the fact that most of our students go to college is insane,” Goodman said. “In the majority of the rest of the country, that’s not the case.”

Students grappling with the stress of high expectations and rising costs of college need avenues for support and a place to hold a healthy conversation.

“Sometimes a student might have the credentials to get into a certain type of school, but their family wants them to go somewhere where they might get scholarship assistance or where it might be more reasonable for their family to take on,” Jones said. “It’s important to understand that every family has different means and is comfortable with different pathways. We can’t [compare] our entire selves to everyone else’s image of their best self. It’s kind of a losing game.”

The lack of choice based on the amount of money a family can afford can affect a student, considering the expectations of peers.

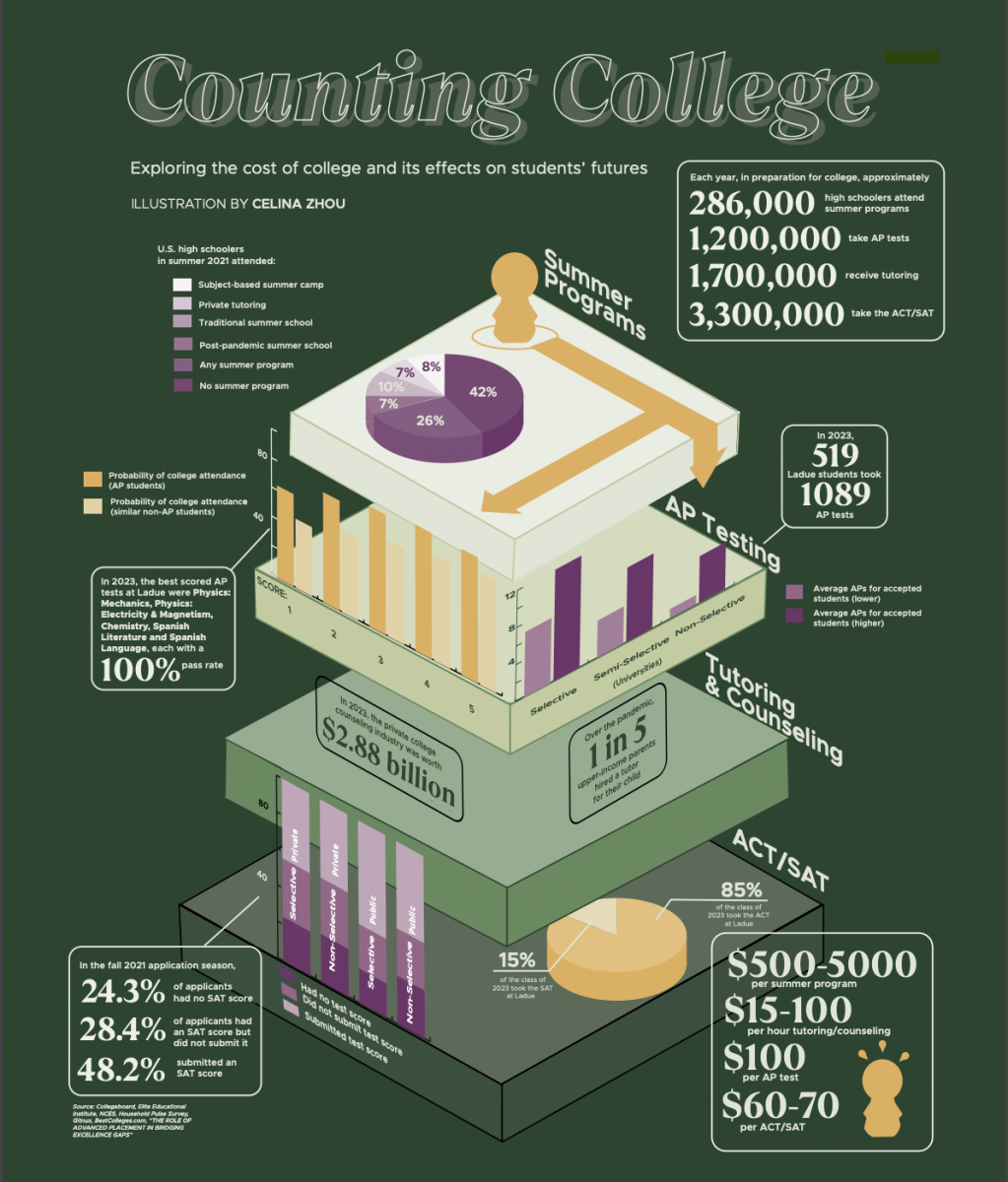

“One of the biggest pressures with the application process was the cost of sending all my test scores,” Speicher said. “That alone was costing a couple $100 sending my scores all over the place. AP test scores themselves were also a big cost. This year I have to spend $600 taking AP tests and last year, I spent $400.”

There is a new call for exploring alternative options in the media, such as community college, trade school or going straight to the workforce. Increasing the importance of mental health and self-discovery in the educational journey promotes the idea that success is not defined by the institution one attends.

“No one needs to have everything figured out before they leave high school,” Jones said. “It’s about knowing yourself and finding what’s best for you in each area of your life. If we can start talking about [mental health] and destigmatizing it, it takes away the shame of asking for help.”

A shift in conversation from the necessity of college to the best fit route for more financial freedom and mental well-being might alleviate the burden on high school students about their future paths.

“Have that healthy conversation with your parents,” Redden said. “There’s opportunities for everyone.”